IndigoCard is a relatively new fintech platform that offers a feature-rich debit card paired with a mobile banking experience. With cash-back rewards and modern tools for managing money, IndigoCard aims to provide an attractive alternative to traditional banking.

Overview of IndigoCard

The IndigoCard debit card and mobile app launched in 2019 as a mobile-first banking solution. The company was founded by a team of fintech veterans who saw an opportunity to leverage technology to reimagine checking accounts and rewards.

Key Features

Some of the key features of IndigoCard include:

- FDIC insured account

- Access to over 55,000 fee-free ATMs nationwide

- Up to 4% cash back rewards on eligible purchases

- Digital account management via mobile app

- Budgeting tools and spending insights

- Instant mobile check deposit

- 24/7 support and dispute resolution

An IndigoCard account operates similarly to a digital-only checking account paired with the convenience of a debit card for payments and withdrawals. All account management from opening an account to tracking transactions can be handled through the mobile app.

OR

Benefits

IndigoCard offers a robust set of benefits that appeal to a wide range of consumers:

- Earn rewards for everyday spending on purchases like gas, groceries, dining, and bills. This provides an engaging way to get value back from routine transactions.

- Avoid fees – there are no monthly fees, maintenance fees, overdraft fees, or transfer fees. This makes budgeting and tracking expenses straightforward.

- Deposit checks instantly with a mobile device for convenient access to funds. Direct deposit ensures paychecks and benefits are available immediately.

- Receive alerts and customizable notifications to stay on top of account activity and catch suspicious transactions early. Advanced security features provide peace of mind.

- Access money anytime from thousands of fee-free ATMs as well as cash back at most merchants. This level of access matches or exceeds traditional banks.

- Upgrade to premium rewards tiers to unlock more perks, higher earn rates, dedicated support, and luxury benefits. There is flexibility to pick the reward level that fits spending habits.

Target Customers

IndigoCard appeals most strongly to digitally savvy consumers who are comfortable managing finances through a mobile interface. Key demographics include:

- Younger adults and millennials are already accustomed to mobile banking and fintech solutions.

- Consumers looking for an alternative to traditional bank accounts with monthly fees and limited rewards.

- Those who frequently shop at merchants where IndigoCard offers elevated cash back rewards, like grocery stores, gas stations, restaurants, and online retailers.

- Travellers who can maximize rewards through travel redemptions and enhanced premium card benefits.

- Small business owners optimise rewards earned on business expenses.

For tech-forward consumers looking for a 21st-century approach to banking, rewards, and money management, IndigoCard hits the mark on critical features and benefits.

| Official Name | My-IndigoCard |

| Managed By | Indigo Card |

| Portal Type | Login |

| Country | USA |

| Language | English |

How IndigoCard Works

IndigoCard combines the capabilities of digital banking apps with the utility of a debit card. Funds can be loaded to the account from external banks or direct deposit and then spent anywhere Visa is accepted.

Linking to a Bank Account

Getting started with IndigoCard requires linking an existing checking account. This allows money to be securely transferred to the IndigoCard account. Accounts can be linked by providing account and routing numbers during the straightforward signup process.

Once the accounts are linked through micro-deposits, funds can be moved to IndigoCard through ACH transfers which typically take 2-4 business days.

Funding the Card

There are several convenient ways to move money to the IndigoCard prepaid account:

- One-time or recurring bank transfers

- Direct deposit of paychecks or government benefits

- Mobile check deposit

- Cash loads at select retail partners

- Peer-to-peer transfers from other IndigoCard members

Maintaining the prepaid account balance is key to managing spending on the card. Funds can be added at any time via the mobile app.

Making Purchases

The IndigoCard debit card enables purchases anywhere Visa is accepted – in-store, online, over the phone, and via mobile wallets. Transactions are immediately deducted from the card’s prepaid balance.

When making a purchase, cardholders can choose to swipe, insert the chip, or pay contactless depending on terminal capabilities. Online and in apps, the IndigoCard can be used by entering the card number, expiration date, and security code.

Virtual card numbers are also available for extra security when transacting online. These disposable numbers can be toggled on or off as needed.

Getting Cash Back

One of the hallmark benefits of IndigoCard is the cash-back rewards program. Cardholders earn varying percentages back on eligible everyday purchases. This money can be redeemed for cash directly to the IndigoCard balance or as statement credits.

Rewards are earned on up to $50,000 in annual spend. Rates range from 1-4% back in popular categories like:

- 4% gas stations

- 3% dining

- 2% groceries

- 1% general purchases

With strategic spending optimized across bonus categories, users can earn over $1,000 per year in value. This provides a lucrative incentive for using IndigoCard as an everyday payment card.

Opening an IndigoCard Account

Getting started with IndigoCard is quick and convenient through the mobile app. Approval typically takes just minutes after submitting the required information.

Eligibility Requirements

To qualify for an IndigoCard account, applicants must:

- Be 18 years or older

- Have a valid Social Security Number

- Be a US citizen or permanent resident

- Pass identity verification checks

- Have a US address and US bank account

Joint or teen accounts are not currently available. Business accounts are also not yet offered but are on the roadmap.

Application Process Step-by-Step

Here is an overview of what to expect when signing up for IndigoCard:

Downloading the App

Start by downloading the iOS or Android app from the respective app store. On launch, tap “Sign Up” to begin a new application.

Entering Personal Information

Early in the application process, users will enter details like:

- Full name

- Email address

- Date of birth

- Home address

- Social Security Number

This information is needed to verify identity and determine eligibility.

Agreeing to Terms

Take time to thoroughly read and understand the IndigoCard Terms & Conditions and Privacy Policy. These important legal documents govern the use of the card and account. You must accept them to proceed with account opening.

Linking Bank Account

A funding bank account will need to be linked to transfer money to your IndigoCard balance. The account and routing numbers will be requested.

For verification, two micro-deposits will be made to the linked account. These deposit amounts must be confirmed within the app to verify access and ownership.

Verifying Identity

As part of identity verification, a photo ID such as a driver’s license will need to be scanned or photographed through the app. Fraud prevention questions may also be presented.

Account Approval

Within minutes of applying, you will be notified if your IndigoCard application is approved or declined. This process is powered by instant automated decisions.

Once approved, you can immediately begin using your new IndigoCard digitally via the app. The physical card ships within 7-10 days.

Funding the Card

To start spending with your new IndigoCard, you will need to fund it with an opening deposit. Ongoing direct deposits or bank transfers will maintain funds.

Initial Deposit

An initial deposit of at least $20 is recommended when activating your card. Have this minimum amount ready via a bank account transfer.

Some new accounts may require a larger initial funding of between $200-$500. Funding requirements are displayed clearly within the app.

Recurring Direct Deposits

Setting up paycheck direct deposit ensures your IndigoCard stays funded each pay period. Government benefits can also be deposited automatically.

Even better, paychecks land a full 2 days early thanks to Indigo’s early direct deposit access. This provides extra flexibility in managing cash flow.

Bank Transfers

Money can be conveniently transferred from an external bank account as needed. These transfers via ACH take 2-4 business days to fully process.

Recurring bank transfers can be scheduled to automatically top up the IndigoCard balance on a set cadence. Manually pushing funds is also an option anytime.

Depositing Checks

Checks can be deposited instantly using the app’s mobile check capture technology. Simply take photos of the check fronts and backs to initiate the deposit.

Up to $5000 per check can be deposited with an $8000 monthly limit. There are no fees or extra charges for mobile check deposits.

Adding Cash

While the IndigoCard does not yet accept direct cash deposits, there are options for adding physical cash.

In-network retail partners like Walgreens allow consumers to convert cash to IndigoCard balances for a small fee. Adding cash through third parties takes 1-2 business days.

Using the IndigoCard

The IndigoCard debit card enables purchases and payments across a wide range of in-person and online scenarios. It can be used virtually anywhere Visa is accepted.

In-Store Purchases

The physical and digital IndigoCard allows cardholders to complete purchases at brick-and-mortar merchants in different ways:

Swiping Card:

For card-present transactions, swiping the IndigoCard through a magnetic stripe reader is the most common method. After swiping, follow the prompts and enter your PIN.

Inserting Chip:

If the payment terminal has an EMV chip reader, insert the IndigoCard with the chip facing up. Leave the card in place until the transaction is processed.

Contactless Payments:

Enabled terminals can accept the IndigoCard via Apple Pay, Google Pay, or Samsung Pay. Just hold your mobile device near the payment area – no swipe or PIN is needed.

Entering PIN:

For debit card purchases and ATM withdrawals, you will need to enter a 4-digit PIN. Choose this code during activation or update it at any time in the app.

Getting Cash Back:

When checking out at grocery stores and other merchants, select “Debit” and enter the PIN. Then choose the cashback amount offered at checkout.

Cash backup to the card’s available balance is instantly available without fees or interest like credit cards.

Online Purchases

The IndigoCard can also be used for online shopping, food delivery, digital subscriptions, and other e-commerce transactions.

Saved Payment Methods:

For frequented online retailers, save the IndigoCard digitally to enable 1-click ordering. As long as funds allow, purchases can be made with just a click.

Virtual Card Numbers:

Temporary virtual card numbers provide an extra layer of security for online purchases at unfamiliar merchants. These digital cards can be toggled on or off as needed.

Mobile Wallets:

The IndigoCard pairs with mobile wallets like Apple Pay, Google Pay, and Samsung Pay. Add the card once, then use the wallet for contactless in-store and in-app payments.

Bill Pay

IndigoCard can be used as the payment method for recurring monthly bills and subscriptions.

Automatic:

Set up autopay directly with billers and service providers. As long as the card has sufficient balance, bills will be deducted automatically monthly.

Manual:

Log in to biller accounts to make one-time payments as needed. Schedule upcoming payments in advance for rent, utilities, car loans, and other bills.

With smart planning, all monthly household and personal bills can be paid seamlessly with the IndigoCard.

ATM Withdrawals

When cash is needed, the IndigoCard grants fee-free access to over 55,000 ATMs in the MoneyPass network. Just locate a compatible ATM and withdraw cash as desired.

Finding Fee-Free ATMs:

Use the IndigoCard app to find nearby ATMs in the no-fee MoneyPass network. These convenient ATMs are located in retailers, gas stations, banks, and more.

Withdrawal Limits:

ATM withdrawals have daily and monthly limits tied to account history and verification level. These amounts range from $500-$2500+ per day.

Check Balances:

Be sure to check the live IndigoCard balance before withdrawals to avoid insufficient funds. The balance updates instantly after transactions.

Having access to thousands of surcharge-free ATMs makes it easy to grab cash conveniently when needed.

International Use

When travelling overseas, the IndigoCard can unlock ATMs and enable purchases globally.

Enabling International Transactions:

Within the app, ensure the international transaction toggle is enabled before travelling. This opens usage outside the US.

Foreign Transaction Fees:

A 3% foreign transaction fee applies to withdrawals and purchases initiated outside the United States. Currency conversion rates also apply.

Chip and PIN:

Some foreign countries and merchants require a chip credit card and a PIN for transactions. The IndigoCard’s EMV chip and PIN capability facilitate this.

With the appropriate precautions and planning, IndigoCard allows cardholders to maintain access to their money while travelling internationally.

Managing the Card

The IndigoCard mobile app provides convenient account management, security controls, alerts, and more.

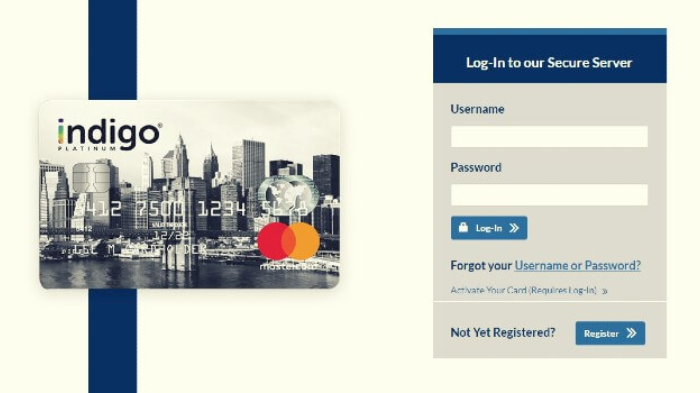

Login to Your Existing Account

If you already have an IndigoCard account, you can log in to manage your account details and card information.

Your online account dashboard lets you monitor your balance, view statements set alerts, make payments, and more.

Follow these simple steps to log in:

- Click “Login” on the homepage

- Enter your email and password

- Complete 2-factor verification

- Access your account dashboard

- Log out when finished

Logging in allows complete control over your IndigoCard account online. Let us know if you need assistance accessing your account portal.

Sign Up for a New IndigoCard Account

Don’t have an account yet? Signing up is quick and easy:

- Download the IndigoCard app

- Enter your details

- Review and accept the Terms & Conditions

- Link a bank account for funding

- Verify your identity

- Get approved in minutes

- Fund your account with $20+

Once approved, you can immediately start spending with your virtual card while your physical card ships. Sign up now to start enjoying the benefits of IndigoCard!

Whether you want to log in to your current account or open a new one, the IndigoCard website makes it simple to manage your account online. Contact our customer service team if you need any assistance with logging in or signing up.

The Mobile App

Account activity can be monitored directly in the IndigoCard mobile app. It also enables critical account management capabilities.

Viewing Transactions:

The intuitive transaction feed shows pending, posted, and cleared purchases with timestamps, merchant names, locations, and categorization.

Checking Balance:

A live updating balance is front-and-centre in the app with timestamps on recent account activity. This data syncs in near real-time.

Freezing/Unfreezing Card:

If your physical card is lost or stolen, it can be instantly frozen via the app to prevent fraudulent use. Temporarily freeze it when not needed.

Changing PIN:

Within the app settings, the card’s 4-digit ATM PIN can be changed anytime. Choose an easy-to-remember but hard-to-guess number for security.

Reporting Fraud:

Suspicious charges can be reported and disputed directly in-app. The card can also be frozen and replacement issued if compromised.

Account Security

IndigoCard was designed as a natively digital platform, with security woven throughout.

Biometric Login:

For quick, secure access, the app can be locked and unlocked with a fingerprint or face scan. This is more convenient than remembering passwords.

Suspicious Activity Monitoring:

Sophisticated machine learning and artificial intelligence monitor account activity in real time to detect potential fraud. This runs silently in the background for prevention.

Alerts:

Cardholders can set customized alerts for transaction types, foreign transactions, large purchases, low balances, and other triggers. Alerts arrive in real-time via push notification and email.

Temporary Holds:

If potential fraud is spotted, temporary holds may be placed on funds while transactions are reviewed. Holds eventually expire or become permanent.

With advanced security tools built-in, IndigoCard strives to keep accounts safe from unauthorized access and abuse.

Card Upgrades

Over time, IndigoCard users can apply for access to premium metal cards with expanded benefits.

Requesting New Card:

Within the IndigoCard app, tap into the upgrades section to view premium card options. Start the request process for the desired card tier.

Premium Card Options:

The IndigoCard Pro and IndigoCard Black cards add more perks, higher rewards, and exclusive benefits like airport lounge access. There are annual fees for these cards.

The sleek metal cards help users stand out with custom designs and luxury touches like weighty stainless steel or titanium alloy materials.

Cardholder Perks

Based on verification level and card type, IndigoCard owners can unlock useful complimentary perks.

Roadside Assistance:

Get free 24/7 roadside help if you experience car troubles like lockouts, empty gas tanks, flat tires, or battery issues. Available at select card tiers.

Travel Insurance:

When paying for travel like airfare or hotels with an upgraded IndigoCard, users get free trip cancellation, delay protection, and lost baggage reimbursement.

Purchase Protection:

Items bought with the card may qualify for complimentary extended warranty protection, price drop refunds, or reimbursement if stolen or damaged.

Depending on the card held and account history, useful complimentary benefits and protections come alongside IndigoCard’s core offerings.

Cash Back & Rewards

One of the top-selling points of IndigoCard is the lucrative cash-back rewards program. Users can earn up to 4% back on common purchases.

How It Works

The IndigoCard rewards program pays out cash back on eligible purchases made with the card. Here’s an overview:

Cash Back Categories:

Cardholders earn bonus cash back at:

- 4% gas stations

- 3% restaurants

- 2% grocery stores

- 1% general purchases

Rates vary both by merchant category and total yearly spending.

Earning Rates:

The base earn rate is 1% back on all purchases up to $15,000 annually. At $15,000+ yearly spend, rates drop to .5% across categories.

At the Pro and Black card tiers, higher earning rates apply to greater annual spending.

Reward Rules:

Rewards accrue daily and can be redeemed anytime. Points expire if an account is closed or terminated by the bank for risk reasons.

Maximizing Cash Back

With strategy, users can optimize rewards earnings to get the most from the cash-back program.

Tracking Categories:

Focus on spending on the highest rewards categories each month. Regularly check which bonus categories you are closest to maxing out.

Remembering Caps:

Be aware of quarterly and annual caps per category to avoid overspending. Spreading purchases across categories nets the highest returns.

Targeted Offers:

Limited-time boosted offers are sometimes available. Adding an offer multiplies rewards on that merchant or category for some time.

Redeeming Rewards

While rewards accumulate automatically, users must manually redeem accrued cash back into the account or as credits.

Auto-Redeem to Account:

Turn on auto-redeem to automatically deposit rewards into IndigoCard account balances monthly when thresholds are met.

Statement Credit:

Points can be redeemed as statement credits against past purchases shown in the account transaction history, offsetting those charges.

Gift Cards:

For a limited selection of popular merchants, points can also be converted into gift cards. Digital gift cards are fulfilled instantly upon redemption.

Redemption Minimums:

Unlike some other programs, IndigoCard does not have a minimum redemption amount. Even small balances can be redeemed frequently.

Status Levels

Loyalty status tiers reward high-earning and high-spending cardholders with enhanced rewards and elite benefits.

Requirements:

Status is determined by annual transactions and gross dollars spent on the card in a calendar year.

Higher tiers like Premium and Elite require $15,000+ yearly spend.

Perks:

Elevated status unlocks rewards boosts, dedicated support, signup bonuses, and account upgrades.

Higher status also qualifies cardholders for the premium IndigoCard Pro and IndigoCard Black products.

Customer Service

IndigoCard focuses heavily on digital-first customer support through in-app messaging and chat. But options for live human assistance remain available.

Contact Options

IndigoCard offers a few ways for cardholders to get questions answered and issues addressed:

Mobile Chat:

Instant chat with a live agent can be initiated directly within the IndigoCard mobile app during business hours. Wait times are displayed.

Email Support:

For inquiries that don’t require real-time follow-up, email to [email protected]. Email volume is high so allow 1 business day for responses.

24/7 Phone Line:

Urgent issues or complex questions can be fielded over the phone anytime by dialling 1-888-INDIGO-1. This should be used sparingly.

In-app and email are best for general queries, while phone should be a last resort for immediate needs.

Self-Service Help

For convenience and speed, IndigoCard offers digital self-service resources.

FAQs

Frequently asked questions provide answers to hundreds of common cardholder topics, searchable without needing to contact support.

Tutorials

How-to videos and step-by-step guides help users learn core features like adding money, setting travel notices, disputing charges, and more.

Cardholder Community

Peer-to-peer support via online forums enables customers to ask questions and give advice to fellow users in a community.

Between comprehensive online help and limited live support, most account and card issues can be resolved independently without having to pick up the phone.

Account Management

Cardholders can manage personal details, notifications, and more directly through the IndigoCard website and app.

Changing Personal Info

Update names, phone numbers, addresses, and other identifying details by accessing the account profile within the mobile app or web dashboard.

Managing Notifications

Choose which account alerts to receive and how. Customize delivery channels and times to fit preferences and avoid unnecessary notifications.

Set Travel Notices

If travelling, set a travel destination and dates in the app to prevent false fraud alerts when the card is used internationally.

Resolving Issues

When something goes wrong, IndigoCard provides avenues to dispute charges, report lost cards, and address errors.

Disputes

Suspicious charges can be disputed directly in-app alongside explanations, documentation, and custom notes to support the claims.

Fraud Claims

Make official fraud claims if the account or card is compromised, including freezing the card and requesting replacements.

Reporting Errors

Submit general account, transaction, or interest errors to be investigated and corrected as applicable. Allow 7 business days.

Between self-service and human support, IndigoCard strives to make it easy to get issues satisfactorily resolved promptly.

Upgrading Your Card

For power users who want premium features, IndigoCard offers metal and virtual card upgrades with enhanced rewards potential.

Premium Card Options

IndigoCard Pro and IndigoCard Black are the flagship premium cards available via upgrade to qualifying users.

IndigoCard Pro:

This mid-level metal card earns:

- 5% cash back on travel

- 3% restaurants

- 2% groceries

- 1% general spending

$195 annual fee

IndigoCard Black:

The top-tier Black card offers:

- 7% cash back on travel

- 4% dining

- 3% groceries

- 2% general spending

$295 annual fee

These cards pack bigger rewards and perks than the standard IndigoCard. But they come at a cost.

Fees for Premium Cards

Unlike the no-fee basic IndigoCard, upgraded cards incur annual fees that vary by tier.

Monthly Fee:

No monthly fees apply, even on premium cards. Only annual fees are charged depending on card type.

Annual Fee:

These annual fees apply:

- IndigoCard: $0

- IndigoCard Pro: $195

- IndigoCard Black: $295

The annual fee is billed automatically each 12 months on the card issuance anniversary.

Added Features

Upgraded cards unlock additional functionality on top of boosted rewards.

Airport Lounge Access:

IndigoCard Pro and Black provide complimentary access to 1,200+ airport lounges globally through Priority Pass Select memberships.

Higher Cash Back:

As shown in the earn rates breakdown earlier, premium cards earn up to 7% back on popular spend categories compared to just 4% maximum on the basic card.

Travel Credit:

For each card anniversary, IndigoCard Black provides a $100 annual travel credit that can be applied to travel purchases. Terms apply.

Perks

Premium cardholders also gain exclusive benefits and elite service levels.

Concierge Service:

IndigoCard Pro and Black feature a 24/7 concierge to help book travel, make restaurant reservations, find tickets to events, send gifts, and more.

Free ATM Withdrawals:

Higher daily ATM withdrawal limits apply. And using out-of-network ATMs no longer incurs fees, saving users even more.

Gift Cards:

Each year, cardholders get anniversary gift cards like $50 to select streaming services or other brands tailored to spending habits.

For big spenders, the upgraded metal and virtual cards provide luxury perks and preferential rewards beyond the base IndigoCard. But at a steeper price.

Alternatives to Consider

While IndigoCard is feature-rich, it may not be the best fit for all consumers. Several compelling alternatives exist.

Traditional Bank Debit Cards

Old-school debit cards from established banks have some advantages:

Overdraft Protection:

Major banks offer overdraft flexibility and lending not provided by IndigoCard’s prepaid account model. This enables overspending when needed.

Established Institutions:

Large banks like Chase, Wells Fargo, and Bank of America have been around for generations compared to IndigoCard’s few years. Their stability and trust may appeal to some.

In-Person Customer Service:

For complex issues or needs, physically visiting a branch and speaking face-to-face may be preferred over IndigoCard’s fully digital interactions.

Other Fintech Options

IndigoCard competes against several other mobile-first fintech platforms:

Chime:

Chime offers a comparable everyday spending account with a debit card, no fees, and a straightforward rewards program.

Current:

Current focuses on teens and families with allowance features and group spending insights.

Aspiration:

Aspiration provides a cash-back debit card aligned with sustainable environmental causes paid for via optional monthly fees.

Varos:

Varos sells premium bank accounts to entrepreneurs and small businesses, not just consumers.

While less rewards-focused, options like Chime, Current, and Varo offer some standout features versus IndigoCard.

Credit Card Rewards

For consumers with established credit, rewards credit cards could be a better choice over IndigoCard:

Sign-Up Bonuses:

Big one-time bonuses like 50,000+ points can be earned when meeting initial spending requirements on many credit cards. IndigoCard has no bonuses.

Additional Perks:

Credit card perks like complimentary hotel elite status, airfare miles, and $100s in annual travel and brand credits provide unmatched value.

Potential Downsides:

Credit card interest, late fees, and long-term debt risk could make debit cards like IndigoCard a wiser choice depending on spending habits.

The Pros and Cons of IndigoCard

IndigoCard deserves strong consideration alongside competitors thanks to its compelling blend of features and rewards.

Advantages

Key strengths of IndigoCard include:

Cash Back Rewards:

Earning up to 4% back on everyday purchases is generous for a debit card program. Conservative users can earn value without debt.

Modern App Features:

The mobile app offers robust digital money management tools for tracking spending and maintaining control.

Premium Card Offerings:

The metal cards provide luxury cachet and premium travel benefits that rival premium credit cards.

Disadvantages

Some potential drawbacks to note include:

No Joint Accounts:

Unlike some competitors, IndigoCard does not allow jointly owned accounts. Each person must apply separately.

Limited Customer Service:

With primarily digital servicing, complex issues cannot be addressed in person at physical branches.

Credit Check for Approval:

The application process involves a soft credit check which could negatively impact scores. This downside is shared across most competitors.

Best Suited For…

Based on its pros and cons, IndigoCard fits optimally for:

Tech-Savvy Users:

Those who are fully comfortable managing money digitally through a polished mobile app will find it most valuable and convenient.

Consumers Shopping Online:

With bonus rewards on online retail purchases, it makes for a lucrative payment option for e-commerce aficionados.

Those With Established Credit:

Approval requires an existing credit profile in good standing. First-time borrowers may struggle to qualify.

The Future of IndigoCard

Like any modern fintech disruptor, IndigoCard must continue rapidly evolving its product and features to stay ahead.

Predicting Product Evolution

IndigoCard will need to continue enhancing its capabilities to fend off rivals. Expected new offerings include:

Bill Pay Automation:

Adding options like scheduled transfers for rent and expanded auto-pay partnerships with billers.

Small Business Offerings:

Introducing tailored products for freelancers and entrepreneurs, like expense management.

International Expansion:

Eventually launching in Europe, Canada, Asia, and Latin America to unlock new markets.

Financial Industry Trends

Some broader financial space trends will also influence IndigoCard’s strategy:

Mobile Banking:

As consumers continue adopting mobile-first banking, the core UX must stay cutting-edge and intuitive.

Cash Back Competition:

More cards from competitors will offer comparable or higher cash-back rates, pushing IndigoCard to increase earning rates.

Security Innovations:

New biometric technologies like face and voice ID must be adopted to prevent fraud. Blockchain applications could further secure transactions.

Final Thoughts on IndigoCard’s Trajectory

IndigoCard has an established base to build upon but much work ahead to stand out in a crowded fintech niche. The biggest challenge will be continuing to evolve both consumer-facing and behind-the-scenes technical features fast enough.

If the company can enhance the mobile experience while also innovating with emerging technologies like blockchain and expanded artificial intelligence, it can defend its positioning. However, the competitive landscape evolves rapidly.

To thrive long term, IndigoCard will need to carefully balance attractive incentives for cardholders with sustainable economics on the backend. The most nimble and disruptive thinkers are likely to dominate the fintech arena going forward.